What are the statutory deductions from an employees salary. RM50 8 hours RM625.

Salary Formula Calculate Salary Calculator Excel Template

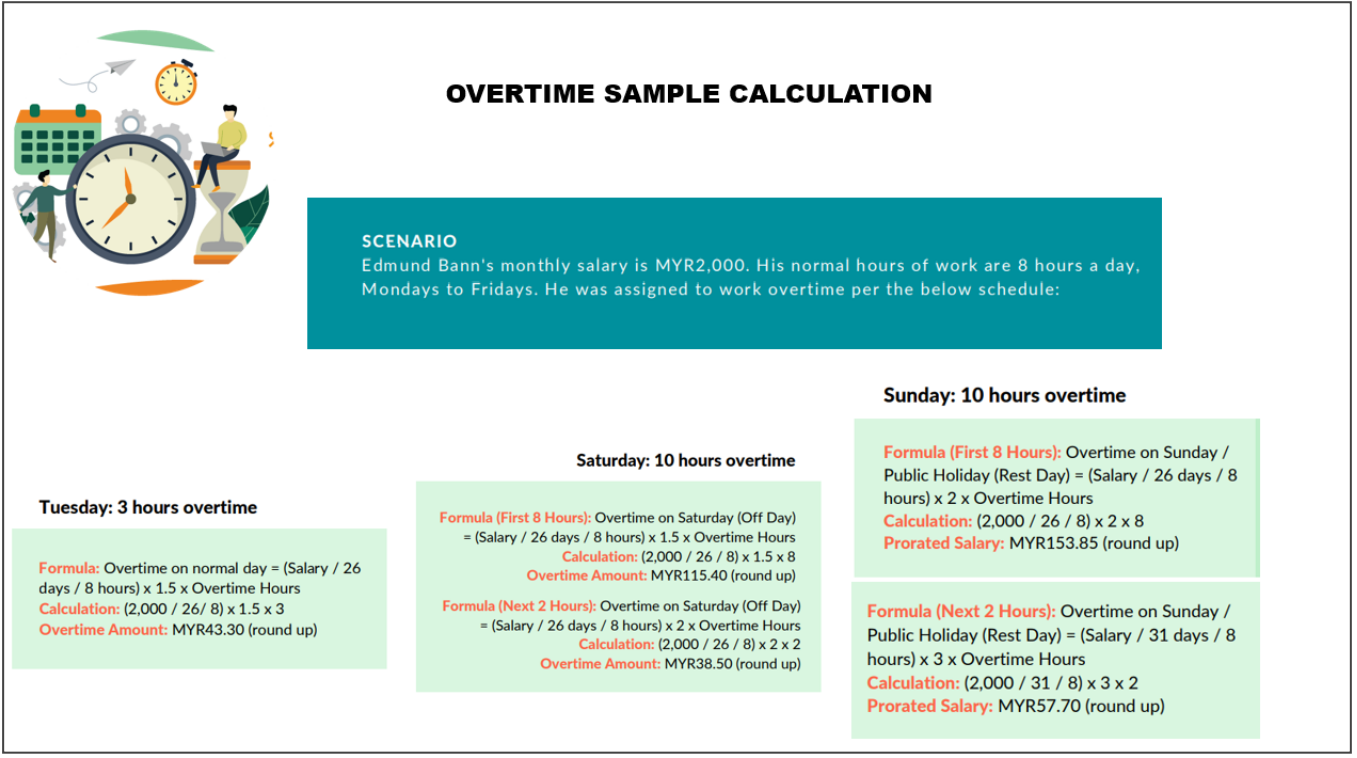

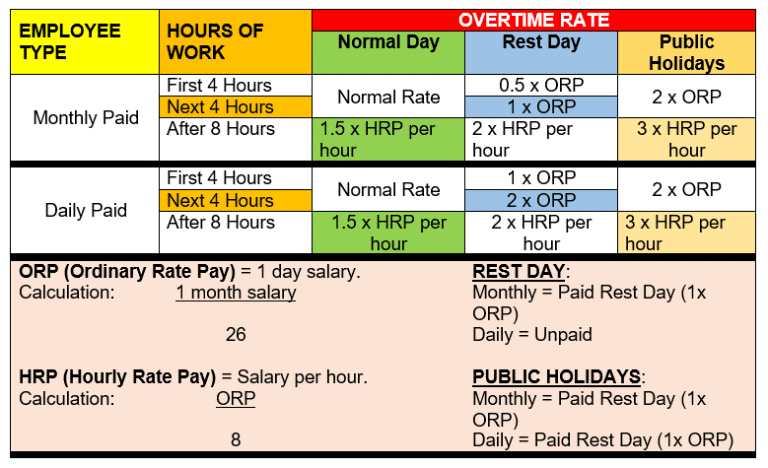

In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws.

. In the system the daily rate of pay is divided by 8. Fixed Number of Days. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

A worker cannnot work for directly for 5 hours non stop without a minimum rest time for 30 minutes. Regulation of Employment Regulation of Employment is part of the Malaysia Labour Law which also consists of Salary Act and Statutory Holiday Table of Contents Regulation of Employment 1. Working days in this month.

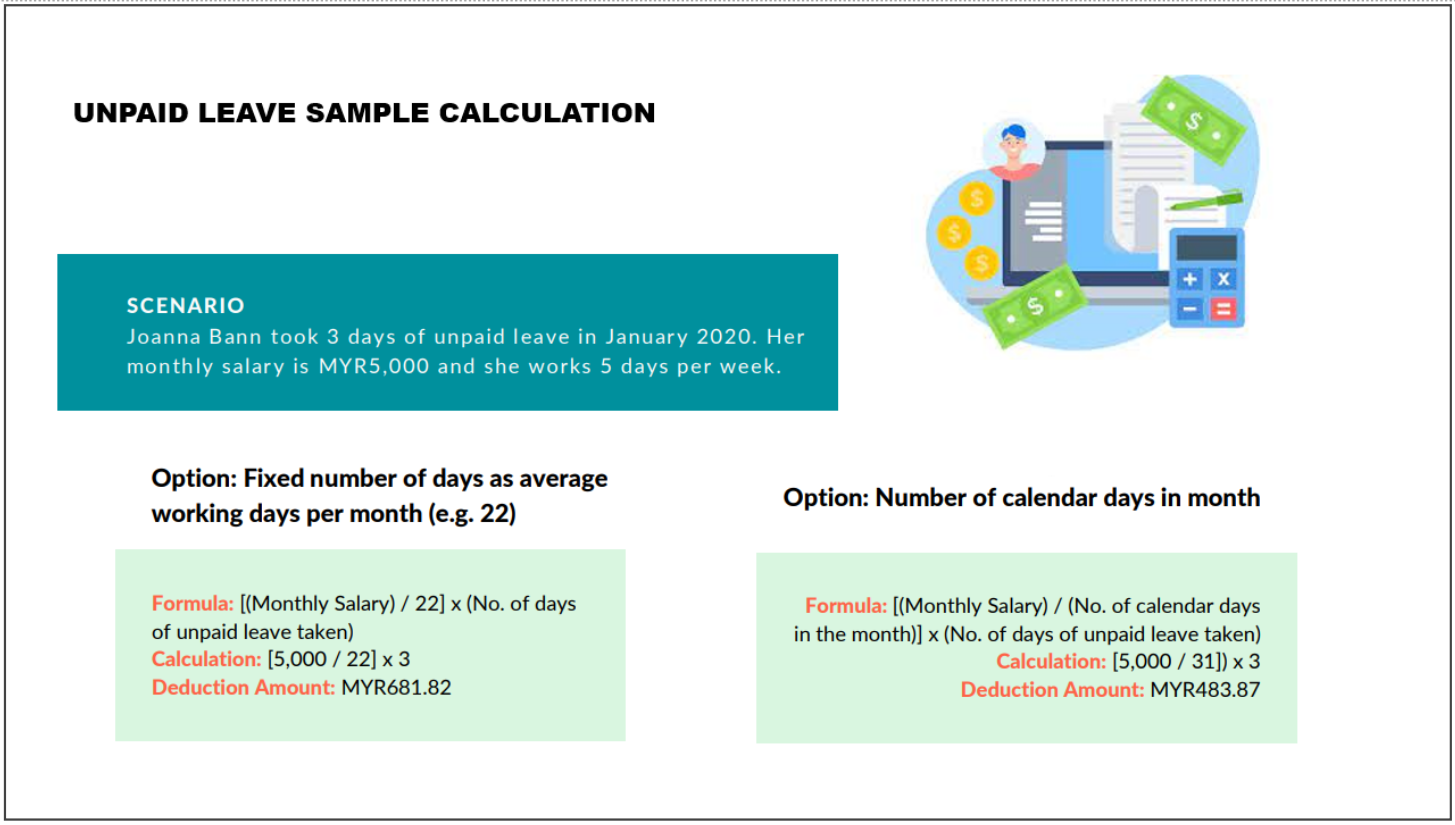

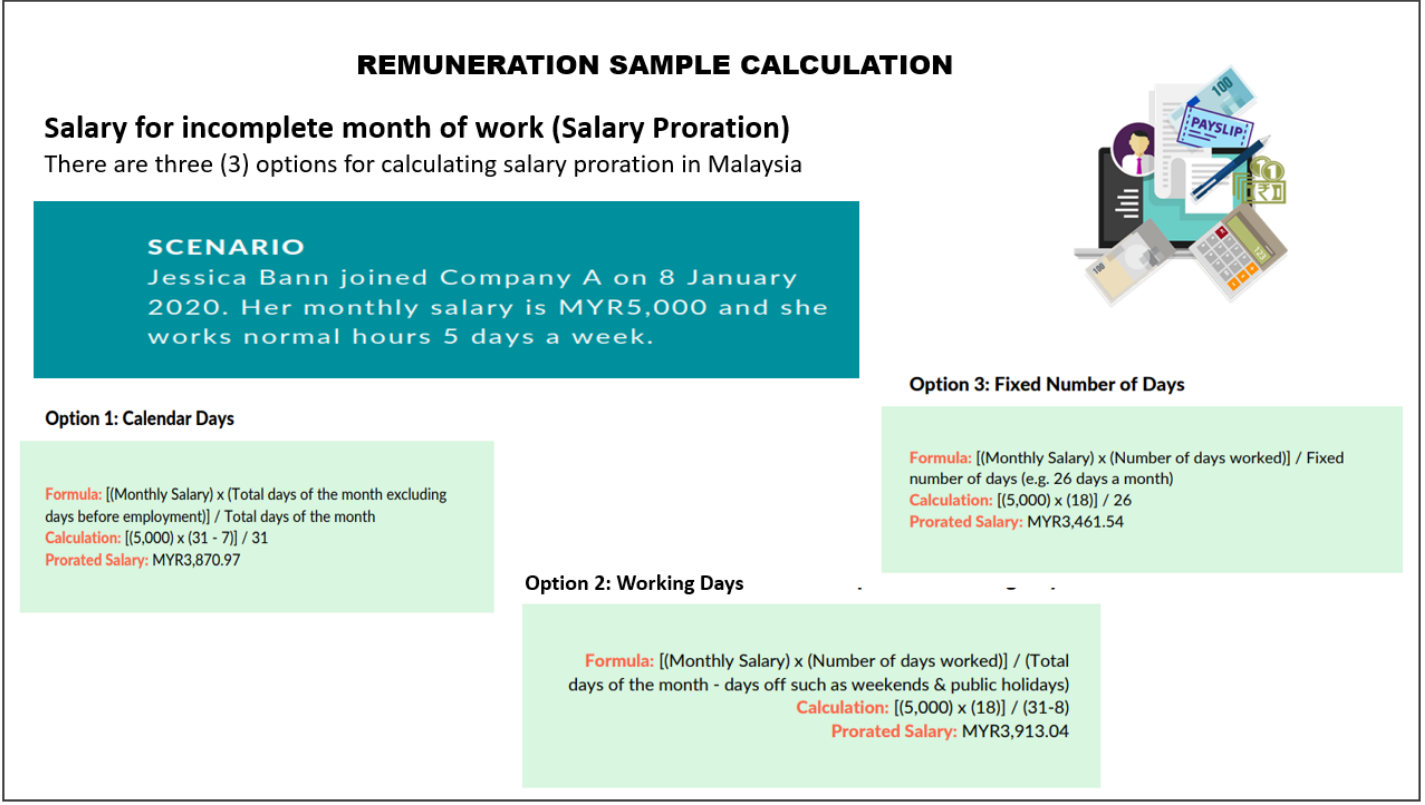

RM2000 3 31. Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week.

Part IX Maternity. Above 5 years 22 days. Now dividing by 26 days.

RM2000 RM19355. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed.

For an incomplete year the calculation will be on a pro-rata basis to the nearest month. Subject Formula Example Ordinary rate of pay daily pay Monthly pay eg minimum wage number of working days ordinary rate of pay RM1000 26 days RM 3846 Hourly rate pay Daily pay normal hours of work hourly rate pay RM 3846 8 hours RM 480. Working hours permitted under Akta Kerja 1955.

For example one employee monthly salarywage is 6000-per month and in any month 30days he worked 15days and avail 2 leave with wage and 4 woff then total pay days is 21days. Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. Divide the employees daily salary by the number of normal working hours per day.

This Guide is a one-stop introductory guide to Malaysian employment law. Employment 1 to 2 years. According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-.

200 of his hourly rate of pay for work done in excess of his normal hours of work. Section 60D 1 of the Employment Act 1955 states that an employee is entitled to paid holidays on eleven of the gazetted public holidays and any other day appointed as a public holiday under Section 8 of the Holidays Act 1951. January has 31 days example for easy calculation working days are required to subtract PH and Sunday Salary Deduction for incomplete month.

According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. Malaysias basic labour law for Employers. But overtime can be a very confusing matter.

There is a tripartite body known as the National Wages Consultative Council. Malaysian law on paid and unpaid leave. Final Salary after deduction of incomplete month.

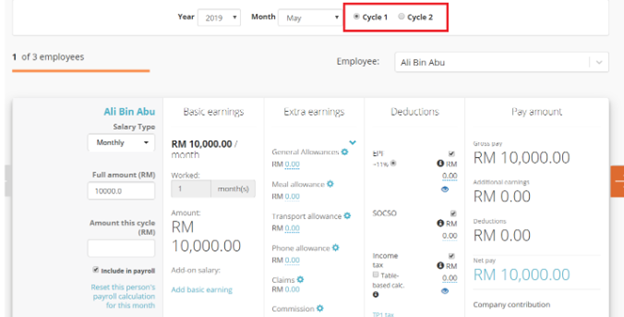

However the Act only covers a number of select employee categories in Malaysia. To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings. To calculate the daily rate you can divide the monthly salary by either of.

Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. In Malaysia overtime is still popular among companies especially in the FB sector. 14 days with pay.

Here this would be RM625 x 15 x 2 hours RM1875. Annual Salary After Tax Calculator. Paid salary6000- 600030 30-216000-20096000-18004200.

Basic Allowance Incentive 26 days 8 hours. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked. Topics covered include employment benefits and terms and conditions data privacy termination of employment retrenchment and unfair dismissals.

Paying employee wages late. Employees who earn monthly wages of RM2000 or less. Now we calculate their salary by dividing 30days.

An employee monthly rate of pay is always fixed to 26. If the employees salary does not exceed RM2000 a month or falls. Malaysian Labour Law.

A worker cannot work more than 8 hours per day and more than 48 hours per week. Salary Formula as follows. How to Perform Salary Calculator Malaysia.

The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. And Sarawak have their own laws eg Sabah Labour Ordinance and Sarawak Labour Ordinance. 3 to 5 years 18 days.

Working days in Current Calendar Month including public holidays. EA Employees are entitled to a paid holiday at the ordinary rate of pay on 11 of the gazetted public holidays and on any. Any employee employed in manual work including artisan apprentice transport.

Any employee as long as his month wages is less than RM200000 and. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -. An employee weekly rate of pay is 6.

Or alternatively we can calculate as.

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Employment Act 1955 Salary Calculations And Benefits Marm

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Your Step By Step Correct Guide To Calculating Overtime Pay

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Employment Act 1955 Salary Calculations And Benefits Marm

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube